Market Analysis

Under development

LPG

A fossil fuel

Liquid Petroleum Gas in its natural form is a gas, but when compressed into a pressurised container, it forms a liquid. LPG has a versatile range of applications and is often a highly sought-after gas with commercial, industrial and domestic uses. LPG is colourless, odourless and combines two natural gases, propane gas and butane gas. Natural fuels formed in the geological past from the remains of living organisms are categorised as fossil fuels, which LPG is. Other examples of fossil fuels are coal and petroleum, and when burned to produce energy, release carbon and nitrogen oxides into the atmosphere, negatively impacting the environment.

Environmentally Friendly

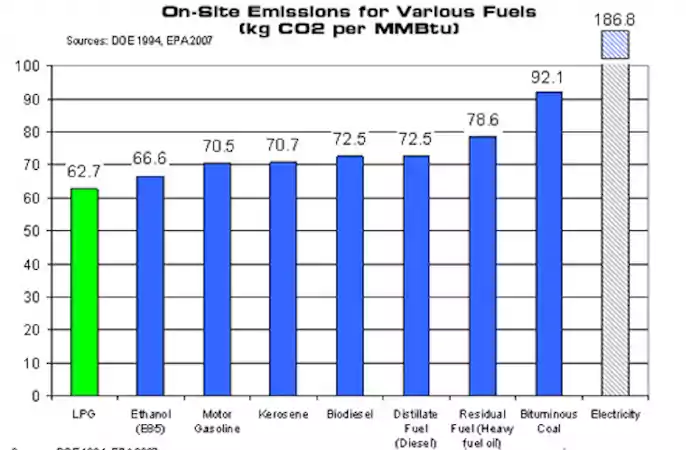

Although LPG is classed as a fossil fuel, it is also considered green energy due to having little implications for the atmosphere with harmful gases. For this reason, and its other benefits, many industries choose this gas. For example, this gas can be stored in canisters of various sizes and is at low risk of keeping in bulk outdoors and indoors. It produces up to 90% less carbon dioxide and is non-toxic. LPG does not contain sulphur, so when burned for fuel applications, it does not release as much carbon into the atmosphere, unlike other fuels such as coal and oil.

The Retail LPG Value chain

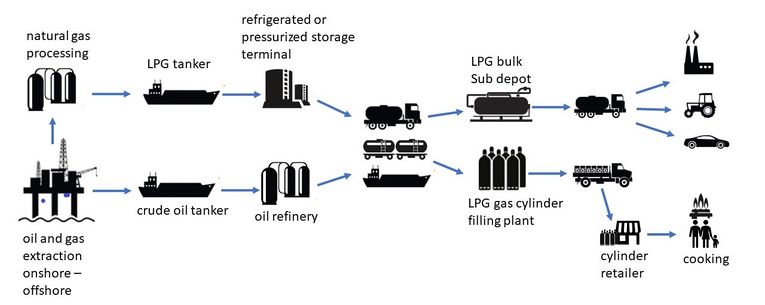

The LPG Value chain

The LPG supply chain starts with production at oil and gas wells and is also referred to as natural gas liquids – NGL. The unrefined oil and gas is shipped to refineries and gas processing plants. The LPG is then transported to downstream storage terminals. Distribution to end users is done with LPG cylinder delivery trucks and bulk LPG tankers. Consumers are typically residential, commercial or autogas users..

The LPG Retail Value chain

Inefficiencies to be addressed:

- Costly Subsidies

- Expensive LPG Retail Chains

- Social Unrest

LPG Consumption

LPG is available in even the remotest of areas, improving the lives of millions of citizens worldwide and providing an impetus to regional development. As relatively few rural or remote areas can benefit from piped natural gas, LPG is an ideal power source for these areas, either as a primary source or in combination with renewable energy. LPG is also increasingly used for large- or small-scale power generation.

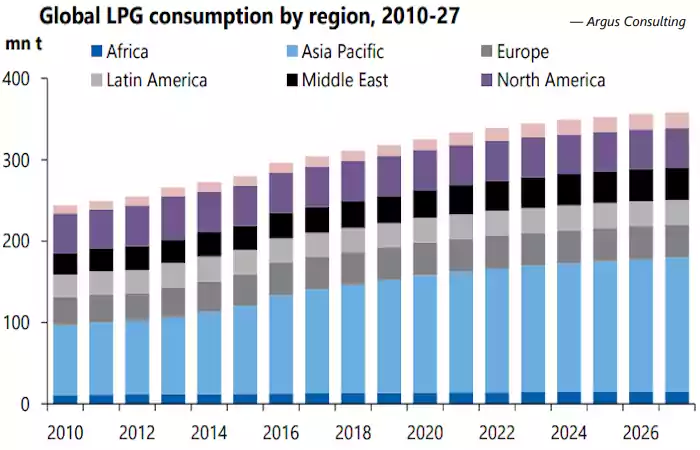

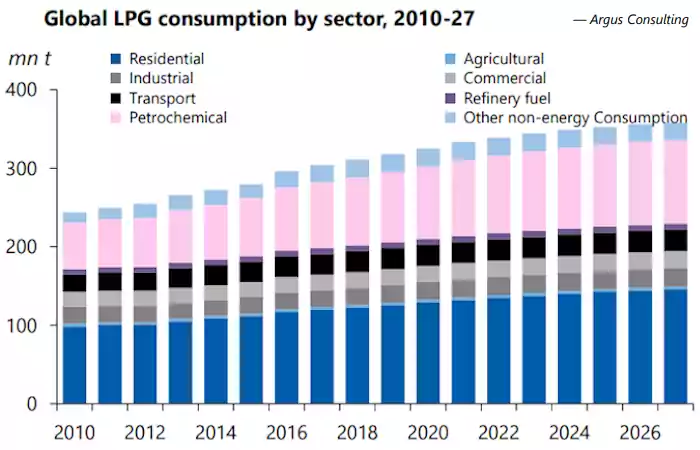

Demand to increase

The Global LPG market is further expected to grow in the forecast period of 2022-2027 at a CAGR of 1.7%.

Multiple industries

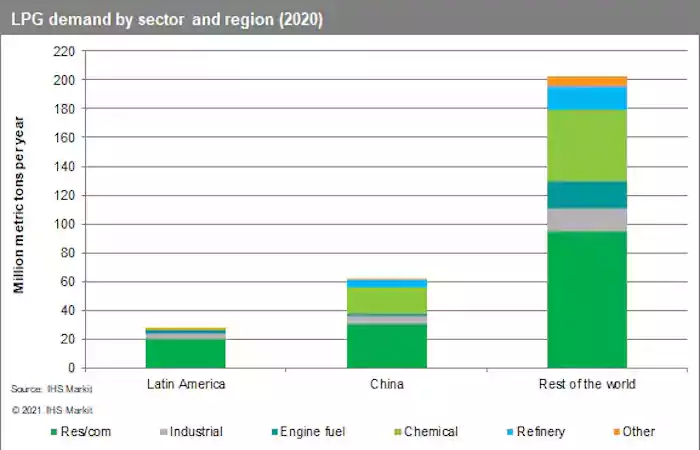

Incremental consumption will be driven by the petrochemical and residential sector. Other sectors are likely to remain flat.

Largest residential

Incremental consumption will be driven by the petrochemical and residential sector. Other sectors are likely to remain flat.

Cleanest fuel energy

LPG has emerged as a clean and efficient source of energy compared to other fossil fuels.

Worldwide Consumptions

In the following map you can see consumption per country. The 30 countries with highest LPG households consumption are selected in the map.

| # | First | Last | # | First | Last | # | First | Last | # | First | Last |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | China | 237.89 | 51 | United Kingdom | 2.06 | 101 | Gabon | 0.23 | 151 | Kosovo | 0.05 |

| 2 | India | 192.30 | 52 | Oman | 1.97 | 102 | Austria | 0.23 | 152 | Denmark | 0.05 |

| 3 | Russia | 91.74 | 53 | Panama | 1.96 | 103 | Cambodia | 0.22 | 153 | Lao | 0.05 |

| 4 | Indonesia | 55.08 | 54 | Yemen | 1.94 | 104 | Ukraine | 0.21 | 154 | St. Lucia | 0.05 |

| 5 | Brazil | 49.60 | 55 | Nepal | 1.91 | 105 | Benin | 0.21 | 155 | Turks and Caicos | 0.04 |

| 6 | Mexico | 39.80 | 56 | Ghana | 1.83 | 106 | Slovenia | 0.21 | 156 | French Guiana | 0.04 |

| 7 | USA | 34.52 | 57 | South Africa | 1.82 | 107 | Fiji | 0.20 | 157 | Norway | 0.04 |

| 8 | Japan | 34.00 | 58 | Lebanon | 1.82 | 108 | Niger | 0.19 | 158 | Belize | 0.03 |

| 9 | Egypt | 32.43 | 59 | Sudan | 1.78 | 109 | Reunion | 0.19 | 159 | Finland | 0.03 |

| 10 | Morocco | 19.88 | 60 | El Salvador | 1.72 | 110 | Réunion | 0.18 | 160 | Bosnia | 0.03 |

| 11 | Iran | 18.53 | 61 | UAE | 1.59 | 111 | Netherlands | 0.18 | 161 | Sweden | 0.03 |

| 12 | Iraq | 13.47 | 62 | Turkey | 1.52 | 112 | Suriname | 0.18 | 162 | Grenada | 0.03 |

| 13 | Thailand | 11.98 | 63 | Kuwait | 1.38 | 113 | Singapore | 0.18 | 163 | Barbuda | 0.03 |

| 14 | Algeria | 11.76 | 64 | Senegal | 1.32 | 114 | Bangladesh | 0.17 | 164 | Aruba | 0.03 |

| 15 | Italy | 10.01 | 65 | Palestine | 1.19 | 115 | Mali | 0.15 | 165 | Guinea-Bissau | 0.03 |

| 16 | Philippines | 9.21 | 66 | Belgium | 1.16 | 116 | Bulgaria | 0.15 | 166 | Mayotte | 0.03 |

| 17 | Saudi Arabia | 9.04 | 67 | Qatar | 1.16 | 117 | Brunei | 0.14 | 167 | Seychelles | 0.03 |

| 18 | Argentina | 8.12 | 68 | Sudan | 1.15 | 118 | Haiti | 0.12 | 168 | Azerbaijan | 0.02 |

| 19 | Viet Nam | 7.76 | 69 | Israel | 1.14 | 119 | Latvia | 0.12 | 169 | Jersey | 0.02 |

| 20 | Kazakhstan | 7.54 | 70 | Tanzania | 1.07 | 120 | Maldives | 0.12 | 170 | Malawi | 0.02 |

| 21 | Other Asia | 7.52 | 71 | Cuba | 0.96 | 121 | Malta | 0.12 | 171 | Tonga | 0.02 |

| 22 | Chile | 7.31 | 72 | Uruguay | 0.90 | 122 | Bermuda | 0.12 | 172 | Mariana | 0.02 |

| 23 | Ecuador | 7.19 | 73 | Albania | 0.83 | 123 | Lesotho | 0.12 | 173 | Samoa | 0.02 |

| 24 | Peru | 6.70 | 74 | Honduras | 0.83 | 124 | Mozambique | 0.11 | 174 | Dominica | 0.02 |

| 25 | Spain | 6.64 | 75 | Cameroon | 0.69 | 125 | Bahamas | 0.11 | 175 | South Sudan | 0.02 |

| 26 | Germany | 6.38 | 76 | New Zealand | 0.63 | 126 | Kyrgyzstan | 0.10 | 176 | Papua | 0.02 |

| 27 | France | 6.24 | 77 | Greece | 0.61 | 127 | Guyana | 0.10 | 177 | CRA | 0.02 |

| 28 | Malaysia | 6.10 | 78 | Antilles | 0.60 | 128 | Togo | 0.09 | 178 | Sint Maarten | 0.02 |

| 29 | Afghanistan | 5.47 | 79 | Costa Rica | 0.60 | 129 | Guadeloupe | 0.09 | 179 | Andorra | 0.02 |

| 30 | Tunisia | 4.42 | 80 | Bahrain | 0.58 | 130 | Polynesia | 0.08 | 180 | St. Kitts-Nevis | 0.01 |

| 31 | Poland | 4.25 | 81 | Hungary | 0.56 | 131 | Georgia | 0.08 | 181 | Iceland | 0.01 |

| 32 | Uzbekistan | 3.87 | 82 | Burkina Faso | 0.52 | 132 | Madagascar | 0.08 | 182 | Montenegro | 0.01 |

| 33 | Pakistan | 3.79 | 83 | Trinidad and Tobago | 0.44 | 133 | Bhutan | 0.07 | 183 | Samoa | 0.01 |

| 34 | Syria | 3.62 | 84 | Mauritania | 0.44 | 134 | Grenadines | 0.07 | 184 | Vanuatu | 0.01 |

| 35 | Dominican Republic | 3.61 | 85 | Jamaica | 0.43 | 135 | Congo | 0.07 | 185 | Comoros | 0.01 |

| 36 | Colombia | 3.61 | 86 | Moldova | 0.43 | 136 | Cayman | 0.07 | 186 | Myanmar | 0.01 |

| 37 | Bolivia | 3.43 | 87 | Mauritius | 0.43 | 137 | Cabo Verde | 0.07 | 187 | Luxembourg | 0.01 |

| 38 | Venezuela | 3.11 | 88 | Nicaragua | 0.43 | 138 | Anguilla | 0.07 | 188 | Montserrat | 0.00 |

| 39 | Nigeria | 3.01 | 89 | Curaçao | 0.40 | 139 | Djibouti | 0.07 | 189 | Armenia | Otto |

| 40 | Côte d'Ivoire | 2.88 | 90 | Belarus | 0.38 | 140 | Zambia | 0.07 | 190 | Solomon | 0.00 |

| 41 | Jordan | 2.88 | 91 | Ireland | 0.37 | 141 | Botswana | 0.06 | 191 | Burundi | 0.00 |

| 42 | Guatemala | 2.80 | 92 | Croatia | 0.36 | 142 | Ethiopia | 0.06 | 192 | Kiribati | 0.00 |

| 43 | Portugal | 2.76 | 93 | Czechia | 0.36 | 143 | Guinea | 0.06 | 193 | Marshall Islands | 0.00 |

| 44 | Australia | 2.69 | 94 | Serbia | 0.35 | 144 | Caledonia | 0.06 | 194 | Tuvalu | 0.00 |

| 45 | Canada | 2.69 | 95 | Uganda | 0.31 | 145 | Estonia | 0.06 | 195 | Sao Tome | 0.00 |

| 46 | Sri Lanka | 2.54 | 96 | Lithuania | 0.29 | 146 | Eritrea | 0.06 | 196 | Eswatini | 0.00 |

| 47 | Angola | 2.52 | 97 | Chad | 0.29 | 147 | Barbados | 0.05 | 197 | Niue | 0.00 |

| 48 | Kenya | 2.37 | 98 | Rwanda | 0.27 | 148 | Macedonia | 0.05 | 198 | Nauru | 0.00 |

| 49 | Libya | 2.34 | 99 | Cyprus | 0.27 | 149 | Slovakia | 0.05 | 199 | Greenland | 0.00 |

| 50 | Romania | 2.07 | 100 | Zimbabwe | 0.24 | 150 | Somalia | 0.05 | 200 | Serbia | 0.00 |

LPG Prices

Sometimes there are not enough providers around or consumers lacks information to freely choose a provider. As a consequence, LPG uses to be a supplier-driven-prices market and the consequence is overcost and delivery inefficiency.

To address this market deficiency, in some countries, governments establish maximum prices. Despite this politic benefits consumers, at the short term, it puts out of the market small retailers, market competence gets damaged and quality of service gets overall degraded, occasionally to the shortage level.

Ecosystem

Filling Plant

LPG Filling Plant is a system which can be used either automatically or manually to refill LPG Cylinders.

Inefficiencies to be addressed:

- Inventory management is done manually and offline

- Risk of running out of cylinder stock

- Wasted man hours

- Lost cylinders

Retailers

Mission:

Inefficiencies to be addressed:

- Lack of cylinder data

- Illegal cylinder filling

- Inefficient milk-runs

- Lack of customer data

Shops

Mission:

Inefficiencies to be addressed:

- Shops have maintenance Costs

- Shops have compliance burden

Logistics

Mission:

Inefficiencies to be addressed:

- Cylinders are lost within the value chain

- Need to buy cylinder replacements

- Retailer staff is not well paid and respected

- Compliance Burden

Independents

Mission:

Inefficiencies to be addressed:

- Independents have difficulty to get customers

- Independents have inability to market their services

- Independents have compliance burden

Consumers

Mission:

Inefficiencies to be addressed:

- Consumers afraid of running out of gas

- Consumers lack market information

- Consumers can not easily change supplier

- Consumers pay overcosts

- Consumers cannot organize delayed deliveries

- Consumers cannot benefit from pre-ordering

- Consumers cannot plan financially

- Consumers may have shortages or lack of coverage

- Consumers do not have a complain procedure