Investors Value

Under development

ICO Investors

Funding Rounds

GasClick will run 3 funding rounds.

Seed Round (ongoing)

Token price$0.03

Hard Cap $300.000

Soft Cap $50.000

% of Pre-mined 5%

Min. Investment $10

Max. Investment $50.000

Pre-Sale

Token price $0.07

Hard Cap $2,800.000

Soft Cap $280.000

% of Pre-mined 20%

Min. Investment $10

Max. Investment $50.000

Public Sale

Token price $0.085

Hard Cap $4,250.000

Soft Cap $425.000

% of Pre-mined 25%

Min. Investment $10

Max. Investment $50.000

Pre-mined Vesting Schedule

The following vesting periods will be applied to the pre-mined allocation:

| Allocation | % Max. Supply | Num. of Tokens | TGE | Vesting |

|---|---|---|---|---|

| Seed Round | 1% | 10.000.000 | 0% | 12 months cliff, 24 months vesting linear (monthly) |

| Pre-Sale | 4% | 40.000.000 | 10% | 3 months cliff, 24 months vesting linear (monthly) |

| Public Sale | 5% | 50.000.000 | 20% | 3 months cliff, 12 months vesting linear (monthly) |

| Exchanges | 4% | 40.000.000 | 20% | 12 months cliff, 48 months vesting linear (quarterly) |

| Project | 1% | 10.000.000 | 0% | 12 months cliff, 24 months vesting linear (monthly) |

| Not Pre-mined Exchange | 5% | 50.000.000 | 0% | Minted by LPG orders |

| Not Pre-mined Project | 9% | 90.000.000 | 0% | Minted by LPG orders |

| Not Pre-mined Operations | 71% | 710.000.000 | 0% | Minted by LPG orders |

Release Schedule

The tokens release for the value capture stage is shown below

Price Estimation

Price Determination

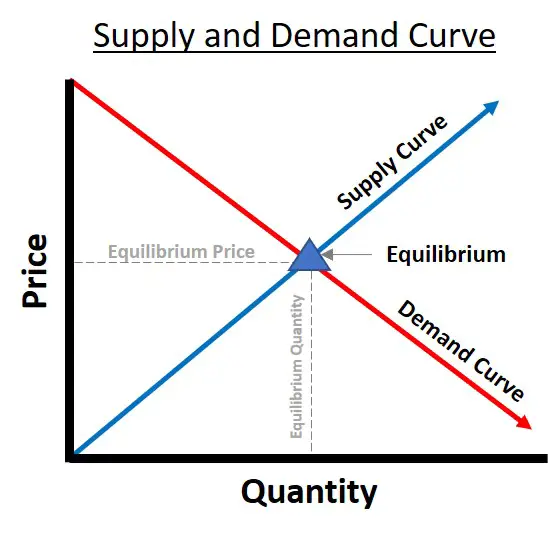

As with any other asset, the price for a token is determined as an equilibrium between demand and supply. Price of Token A expressed in token B is the number of units of token B that investors are willing to pay to acquire a unit of token A.

This evaluation between supply and demand is carried out in the exchanges. Additionally price for a token pair uses to be uniform across the exchanges because arbitrage.

The lower the total traded supply amount across the liquidity pools for a token, the higher the price will get in the exchanges.

Price Components

As in CRYPTOGAS the supply is fixed in the Value Capture Stage, the price will be only determined by demand, as described in CRYPTOGAS Engineering. In order to increase CRYPTOGAS price we must increase the demand of the token. This will move to investor to hold CRYPTOGAS in their portfolios, the traded supply will be reduced and the price will move higher.

The price will have several components.

* 1 - By guaranteeing that the intrinsic value of the underlying asset is captured we can assume that at the medium term, the value of the token will be 15$. Besides the described base scenario, there are additional deflationary reasons that suggest price of underlying asset will get higher from this baseline:.

* 2 - Gas prices are growing because oil scarcity

* 3 - A token shared by millions can easily find additional utilities in the shape of DeFi Services

* 4 - Finally we must maximize speculative value by providing quality of products and services.

Price Stability

The tokens release for the value capture stage is shown below

Value Capture Estimation

Value Capture Components

Value Capture Event happens when the number of tokens in exchanges matches the number of monthly delivered orders.

Exchange Supply Ratio is a metric that indicates the number of tokens in the exchanges vs the total supply. In order to calculate this metric, you must now the addresses of all the exchanges were a token is traded and monitor their holdings. As a reference, the Exchange Supply ratio for bitcoin uses to be around 10-15%.

To estimate the number of tokens in the exchanges we have to consider several components:

- Total Supply considering vesting periods. Total Supply for the Value Capture stage for CRYPTOGAS is 150 millions, but vesting periods guarantee that the supply is released periodically. You can explore vesting periods here

- Money held in Investor Wallets. We cannot estimate this. The only thing we can do is work hard to create value so the demand of the token can be increased.

- Money held in Consumer Wallets. This is the money that LPG consumers maintain in their wallets.

- Money held in Cards. You can explore money held on cards here

So we can apply the formula below:

An estimation of CRYPTOGAS held in exchanges is represented in the chart below.

The number of monthly orders has been estimated here.

According to the estimations, LPG value would be capture in CYGAS token, which means 1 CYGAS = 1 LPG cylinder in October 2028.

Discussion

Investors are busy people and do not like to have their money locked. Estimations are just a method of gauging the output according to some defined inputs. We can, of course advance the Value Capture Event in time by improving our outcomes beyond the estimated ones.